Introduction:

When generating GSTR-1 using Tally Prime, users often encounter various errors that can disrupt the return filing process or cause mismatches upon upload to the GST portal. Identifying these errors early and knowing the necessary corrections are crucial for smooth filing and compliance..

Common GSTR-1 Errors in Tally Prime

Below is a curated list of the most frequent errors observed during GSTR-1 preparation in Tally Prime. Each item is an independent issue that will be covered in detail in separate blogs as part of this series:

- Uncertain Transactions : Transactions where GST details are incomplete or inconsistent. These are flagged in Tally as needing review and correction before being included in GSTR-1 exports.

- Invalid or Missing GSTIN : GSTIN either missing or incorrectly entered for company or parties, leading to rejection on the portal.

- Invalid UQC (Unit Quantity Code) : UQC for HSN is either blank, invalid, or not chosen from the GST-recommended list.

- HSN/SAC Issues : Missing, invalid, or mismatched HSN/SAC codes, including using the wrong code type for goods vs. services, or incorrect number of digits.

- Master and Transaction Mismatches : Data mismatch between master records (like party or ledger) and voucher entries, leading to inconsistencies.

- Place of Supply/State Code Errors : Discrepancy between the place of supply and state code, or incorrect creation/spelling of state names.

- Duplicate Voucher/Document Number : Using the same voucher number in multiple transactions, which is not allowed for GSTR-1 filing.

- Tax Ledger Not Specified or Incorrect : Tax ledgers missing or wrongly used in transactions result in acceptance failures.

- Tax Rate Not Entered or Overridden : No tax rate specified, or manual overrides causing mismatches with portal validations.

- UOM Not Mapped to UQC : Units of measurement not correctly mapped to UQC as required in GSTR-1 specifications.

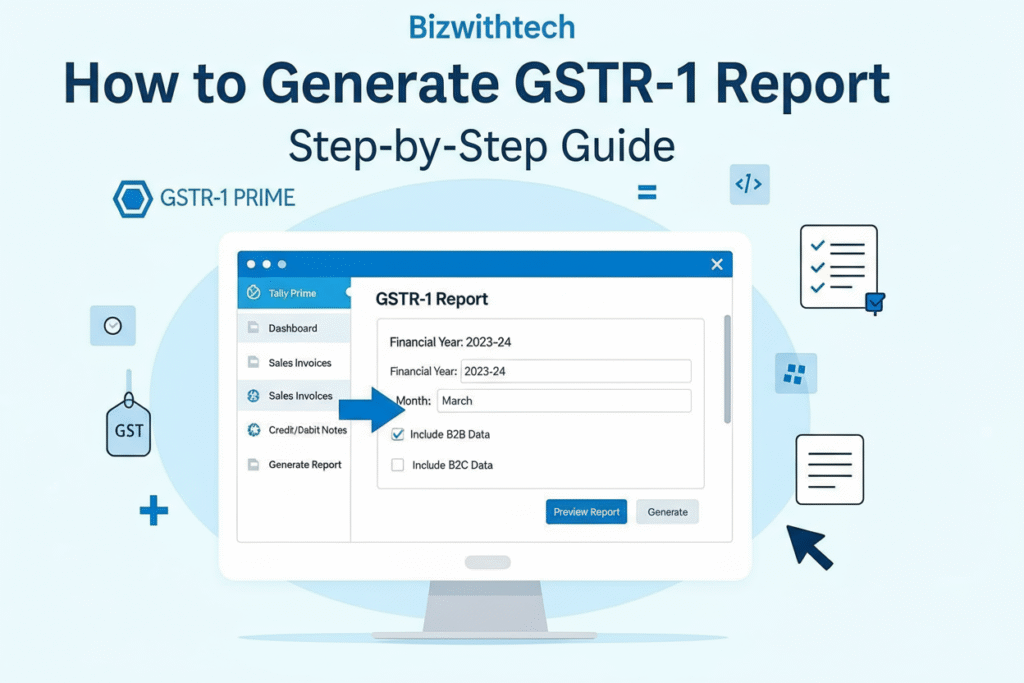

- Segregation of B2B and B2C Supplies : B2B and B2C transactions not properly separated in reporting, especially for HSN summaries.

- Errors in JSON Export/Upload : Issues in the JSON file—such as missing section data—that prevent successful upload to GSTN.

Conclusion

Each error listed above is a frequent stumbling block for businesses using Tally Prime to file GSTR-1. By understanding and addressing them one at a time, users can ensure accurate and efficient GST compliance. Stay tuned for dedicated articles on troubleshooting and correcting each of these errors in upcoming posts.

Need GST setup or monthly GST return support? Contact Us for support or remote help.

FAQs – Errors While Creating GSTR-1 in Tally Prime

Uncertain transactions are those with incomplete or inconsistent GST details, preventing Tally from classifying them correctly in the GSTR-1 report. They need correction for accurate filing.

Verify and enter the correct GSTIN for parties in the company ledger and transaction vouchers. This is crucial as missing or wrong GSTIN leads to JSON upload failure on the GST portal.

Ensure that the Unit Quantity Code (UQC) is valid and mapped against HSN. Check that HSN codes are accurate, even-digited, and appropriate for goods or services (SAC for services should start with '99')

Place of supply must correspond correctly to state codes. Errors occur if states are manually created with wrong spellings or codes, or if the place of supply and state of supplier mismatch for interstate supplies.

Each transaction must have a unique voucher number. Duplicate voucher numbers across invoices cause filing errors and must be corrected by renumbering or sequencing vouchers properly

Errors occur if tax ledgers are not specified or if the tax rate is missing or overridden incorrectly in transactions. Ensure all tax details are accurately maintained per GST rates.

Errors include missing section data, invalid invoice details, or incorrect tax details in the JSON file. Keeping Tally updated and verifying all data fields before export helps prevent these errors.

Use the "Uncertain Transactions" and "Exception Types" report sections in Tally Prime to identify and correct errors in vouchers and masters systematically.